What Does It Mean When My Health Insurance Sends My Claim to Review

Medical claims are 1 of the most valuable sources of data for healthcare organizations. All-payer claims contain detailed diagnosis and process information for any billable patient visit. Healthcare organizations tin apply this claims information to:

- Trace referral patterns

- Improve population health

- Increment sales, and

- Accelerate their go-to-marketplace strategy

Information technology tin be difficult to do all this without fully understanding medical claims data. In this weblog, nosotros will help y'all larn the basics about medical claims: what they are, where they come from, and what they mean.

What is a medical claim?

A medical claim is a bill that healthcare providers submit to a patient's insurance provider. This nib contains unique medical codes detailing the care administered during a patient visit. The medical codes draw any service that a provider used to render care, including:

- A diagnosis

- A process

- Medical supplies

- Medical devices

- Pharmaceuticals, and

- Medical transportation

When a provider submits a merits, they include all relevant medical codes and the charges for that visit. Insurance providers, or payers, assess the medical codes to determine how they will reimburse a provider for their services. In a value-based care model, length of stay and 30-solar day readmissions bear upon provider reimbursements.

What information does a medical claims file comprise?

Every medical claims file contains details specific to each patient and patient encounter. In a medical claims file, this information is in two parts: the claim header and the merits detail.

Claim header

The claim header summarizes the most essential data in the claim. This includes confidential patient information like date of birth, gender, and zip code. The claim header also contains details similar:

- National Provider Identifier (NPI) for the attention physician and the service facility

- Primary diagnosis lawmaking

- Inpatient process, if applicable

- Diagnosis-related group (DRG)

- Name of the patient's insurance company, and

- Overall charge for the claim

Merits detail

The merits detail includes information about secondary diagnoses or procedures administered during an inpatient hospital stay. Each new merits item, or service tape, contains the following information:

- Date of service

- Process code

- Corresponding diagnosis lawmaking

- National Drug Code (NDC), if applicable

- Attending physician'south NPI number, and

- Charge for the service

What is a medical claims clearinghouse?

A medical claims clearinghouse is an electronic intermediary between healthcare providers and payers. Healthcare providers transmit their medical claims to a clearinghouse. Clearinghouses so scrub, standardize, and screen medical claims earlier sending them to the payer.

This process helps mitigate errors in medical coding and reduce the time to receive provider reimbursement. If a claim contains medical coding errors or fails to meet formatting requirements, the payer could decline it. This means that the merits would be resubmitted, delaying provider reimbursement.

The service that clearinghouses provide is likewise beneficial for payers. Clearinghouses format medical claims data according to the unique requirements of each payer. Standardizing the data in this fashion helps payers streamline their medical billing process.

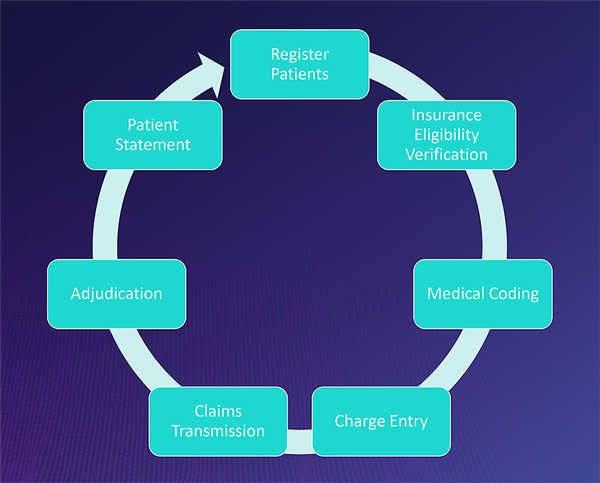

What does the medical billing process look like?

The medical billing procedure contains seven essential steps. These steps trace the entire claims journey from the moment a patient checks in at a healthcare facility, to the moment they receive a neb from their insurance provider.

Fig. 1 Illustration of the medical billing process. Circumvolve diagram displays the 7-footstep procedure that a medical claim must pass through. Illustration from The Definitive Approach to Healthcare Sales – 101: Codifying the Patient Journey.

Patient registration

Patient registration is the very first pace in the medical billing process. Registration occurs when a patient gives their provider personal details and insurance data.

Insurance eligibility verification

After a patient has registered, the care provider must verify the patient's insurance. This helps to confirm that the patient has adequate coverage for the care that they volition receive. Verification helps intendance providers make up one's mind coverage and eligibility, and appraise the post-obit:

- What the patient'southward policy benefits are

- Whether the patient has accumulated co-pay, deductible, or out-of-pocket expenses

- Whether the patient's insurance provider requires pre-authorization

Medical coding

Medical coding is a critical step that occurs after intendance has been administered. Care providers transcribe their notes and other clinical documentation into standardized medical codes. Some of the most mutual medical coding systems include:

- Diagnosis-related group (DRG)

- Current procedural terminology (CPT)

- Healthcare mutual procedure coding system (HCPCS)

- International nomenclature of diseases (ICD-x), and

- National drug code (NDC)

Intendance providers use these codes to describe which medical diagnoses, procedures, prescriptions, and supplies they administered and why. The specificity of medical codes also helps providers describe the patient's condition.

Charge entry

Accuse entry is the last pace before care providers submit their merits for payment. Providers or medical billing specialists list the charges that they look to receive.

Claims transmission

Claims transmission is when claims are transferred from the care provider to the payer. In most cases, claims are beginning transmitted to a clearinghouse. The clearinghouse reviews and reformats medical claims before sending them to the payer.

In some cases, healthcare providers send medical claims directly to a payer. High-volume payers like Medicare or Medicaid may receive bills directly from providers. This helps to reduce the time that it may take to receive reimbursement from loftier-volume payers.

Adjudication

Adjudication occurs once the payer has received a medical claim. The payer evaluates the claim and decides two important things:

- Whether the medical claim is valid, and

- How much of the merits they will reimburse

If the claim is accustomed, the payer volition issue provider reimbursement and accuse the patient for any remaining amount. The payer may deny the claim if the patient has insufficient coverage or did not become pre-authorisation for a service. If a payer denies a medical claim, the patient may have to submit an appeal to gain coverage for the care costs.

The payer may also reject a claim. This happens when the claim does not see formatting requirements or contains an error in medical coding. Rejected medical claims can be resubmitted for payment in one case the errors have been corrected.

Patient argument

Patient statement is the final step in the medical billing process. Once the payer has reviewed a medical merits and agreed to pay a certain amount, the payer bills the patient for any remaining costs.

Larn more

Are you lot interested in learning more near medical claims data and how to apply it? Catch an on-need replay of our webinar: The Definitive Arroyo to Healthcare Sales – 101: Codifying the Patient Journey. The presenters provide a comprehensive overview of medical claims data, including details nigh:

- Types of U.South. insurance programs

- Types of clinical codes

- How to find the right codes for your use-case

- Custom reporting capabilities, and

- Definitive Healthcare's medical claims database

Source: https://www.definitivehc.com/blog/medical-claims-101-what-you-need-to-know

0 Response to "What Does It Mean When My Health Insurance Sends My Claim to Review"

Post a Comment